Furniture Fixtures Depreciation Rate Companies Act . 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

from studylib.net

129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings.

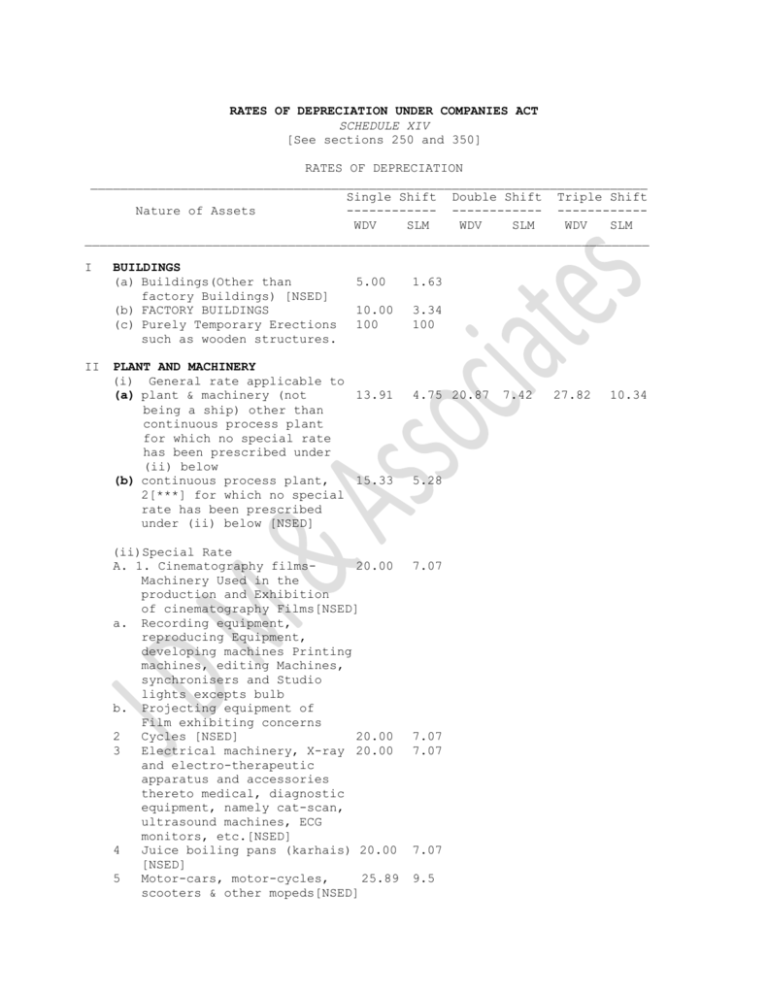

RATES OF DEPRECIATION UNDER COMPANIES ACT SCHEDULE

Furniture Fixtures Depreciation Rate Companies Act 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,.

From exokyzcva.blob.core.windows.net

Depreciation For Furniture As Per Companies Act at Lena Pina blog Furniture Fixtures Depreciation Rate Companies Act 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. depreciation rate chart as per part c of schedule ii of. Furniture Fixtures Depreciation Rate Companies Act.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Furniture Fixtures Depreciation Rate Companies Act 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets. Furniture Fixtures Depreciation Rate Companies Act.

From exodfsivt.blob.core.windows.net

Depreciation On Furniture And Fixtures Rate at Lawrence Manzi blog Furniture Fixtures Depreciation Rate Companies Act depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. companies act 2013 does not provide the rates of the depreciation, instead. Furniture Fixtures Depreciation Rate Companies Act.

From cehlaabq.blob.core.windows.net

Useful Life Of Furniture And Fixtures As Per Companies Act 2013 at Furniture Fixtures Depreciation Rate Companies Act 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. companies act. Furniture Fixtures Depreciation Rate Companies Act.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Furniture Fixtures Depreciation Rate Companies Act depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. Depreciation is the systematic allocation of the depreciable amount of an asset over. Furniture Fixtures Depreciation Rate Companies Act.

From exozemyaq.blob.core.windows.net

Depreciation Rate For Furniture In Kenya at Angela Fagan blog Furniture Fixtures Depreciation Rate Companies Act Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life. Furniture Fixtures Depreciation Rate Companies Act.

From www.scribd.com

Accum. Depreciation, Fur. & Fixture Merchandise Inventory Furniture Furniture Fixtures Depreciation Rate Companies Act 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. Depreciation is the systematic allocation of the depreciable amount of. Furniture Fixtures Depreciation Rate Companies Act.

From exokyzcva.blob.core.windows.net

Depreciation For Furniture As Per Companies Act at Lena Pina blog Furniture Fixtures Depreciation Rate Companies Act 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 129 rows a table is given below of depreciation rates applicable if the asset is purchased. Furniture Fixtures Depreciation Rate Companies Act.

From www.slideteam.net

Depreciation Furniture Fixtures Ppt Powerpoint Presentation Pictures Furniture Fixtures Depreciation Rate Companies Act depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. companies act 2013 does not provide the. Furniture Fixtures Depreciation Rate Companies Act.

From www.vrogue.co

Depreciation Rate As Per Companies Act How To Use Dep vrogue.co Furniture Fixtures Depreciation Rate Companies Act 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.. Furniture Fixtures Depreciation Rate Companies Act.

From dxowuwrzv.blob.core.windows.net

Furniture And Fixtures Depreciation Life Irs at Fausto Stokes blog Furniture Fixtures Depreciation Rate Companies Act 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the. Furniture Fixtures Depreciation Rate Companies Act.

From go-green-racing.com

Furniture And Fixtures Depreciation online information Furniture Fixtures Depreciation Rate Companies Act companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 103 rows as per schedule ii of companies act, 2013 the description of fixed assets has been more detailed to. 127 rows in this article we have compiled depreciation rates under companies act. Furniture Fixtures Depreciation Rate Companies Act.

From gstguntur.com

Depreciation Rate Chart as per Companies Act 2013 with Related Law Furniture Fixtures Depreciation Rate Companies Act 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. 103 rows. Furniture Fixtures Depreciation Rate Companies Act.

From www.vrogue.co

Depreciation Rate As Per Companies Act How To Use Dep vrogue.co Furniture Fixtures Depreciation Rate Companies Act depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 103 rows as per schedule. Furniture Fixtures Depreciation Rate Companies Act.

From exodfsivt.blob.core.windows.net

Depreciation On Furniture And Fixtures Rate at Lawrence Manzi blog Furniture Fixtures Depreciation Rate Companies Act depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. 129 rows a table is. Furniture Fixtures Depreciation Rate Companies Act.

From www.scribd.com

Depreciation Rates Companies Act.pdf Engines Taxes Furniture Fixtures Depreciation Rate Companies Act 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. companies act. Furniture Fixtures Depreciation Rate Companies Act.

From dxoqalekx.blob.core.windows.net

Depreciation Value For Furniture at Kelly Rodrigues blog Furniture Fixtures Depreciation Rate Companies Act 129 rows a table is given below of depreciation rates applicable if the asset is purchased on or after 01 st april,. companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful life based on. depreciation rate chart as per part c of schedule ii of. Furniture Fixtures Depreciation Rate Companies Act.

From exovrawwf.blob.core.windows.net

Depreciation Rate Furniture Rental Property at Charles Franklin blog Furniture Fixtures Depreciation Rate Companies Act 127 rows in this article we have compiled depreciation rates under companies act 2013 under written down. depreciation rate chart as per part c of schedule ii of the companies act 2013 nature of assets useful life rate [slm] rate [wdv] v furniture and fittings. 129 rows a table is given below of depreciation rates applicable if. Furniture Fixtures Depreciation Rate Companies Act.